ALL YOUR FINANCES IN ONE PLACE

DOE

INTRO

ABOUT

DOE is a financial management mobile application. It is design to effectively inform users, their current financial status and how to efficiently manage their assets. The users are able to see their financial summary and get notifications of the movements on all accounts real-time.

PROBLEM

Most thais have problem managing

thier money in different accounts agaist

thier expenses.

SOLUTION

A platform that aggregates and generates a summary of all the users financial assets

and liabilities in once place.

PROJECT DURATION

TEAM

MAIN ROLE

4 Months

3 people

Project managment

Research Business Model Development Design Development

RESEARCH

LITERATURE RESEARCH

Online and Mobile banking has had significant growth in Thailand during 2013-2015, providing users with easier access to their banking information and services. However, according to a survey conducted by VISA, Thais has the highest rate of “Mysterious Spending”. They are unable to account for almost three quarters of their average weekly expenses, because they fail to track their spending.

COMPETTITIVE ANALYSIS

Competitive analysis was conducted to understand the financial management products those are already in them market.

We looked at different features those are offered to help the user manage their finances as well as their business model of running

the application.

USER INTERVIEWS

20 users were selected for interview under the criteria that they: own at least 1 credit card, use mobile banking and has a limited

budget but not in financial trouble. The goal of the interview is to understand current behaviors how user manages their finances

as well as their struggles and needs.

SYNTHESING THE RESEARCH

PERSONAS

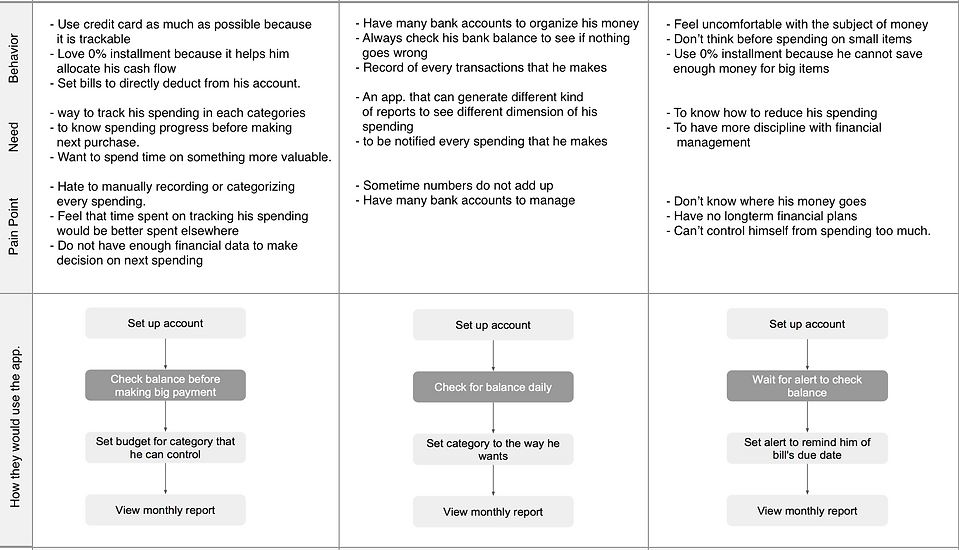

The findings from the research had provided us a clearer understanding about the users behaviors, needs and pain-points around managing their finances. This also allowed us developed three personas which later help guided us during the design phase.

These personas allowed us to create an MVP that took into account their motivations for using the app. and how they would use the application

FEATURES FOR PRODUCT SOLUTION

Features that would respond to the needs and painpoint of each personas were listed and compared on how important it is to each

personas. The Procrastinator was chosen as the primary persona for the MVP. The persona's features prioritisation will influence the information heirachy in the design phase.

DESIGN PHASE

DESIGN DIRECTION

ORGANISING THE STRUCTURE

INITIAL WIREFRAMES

USERS' FEEDBACK

- Not sure about credibility of Thai Application

- What if they user our financial information for something else

- Its kind of scary that they know about every transaction I make.

- Its ok because i am still protected by my Bank OTP

- If they can connect to the bank it should be OK, because the bank would have already verified them

- I am not afraid to give my bank username and password, because its only my spending account, not my saving.

- I am not afraif of being hacked, because I leave very little money in spending account.

THE REFINEMENT

FINAL PROTOTYPE

PROJECT STATUS:

After numerous usability testings were conducted on the prototype, we have discovered that most users do not have enough trust to the brand to input their internet banking credentials. We foresee that this would slow down the traction significantly.

The marketing cost to gain the trust would also have a negative impact on our original business model.

However, we are still working to find a business viable solution for this and bring the application to the market.